Honda and Nissan Merger Talks Signal Shift in Automotive Strategy

Legal Complexities and Global Implications for Japan's Automotive Industry

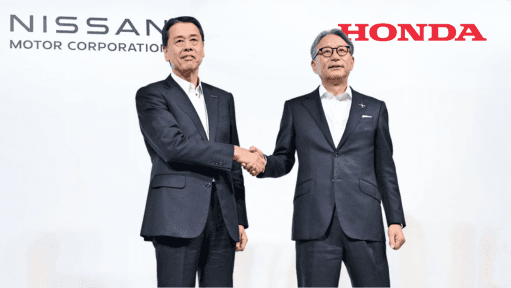

Honda and Nissan to Begin Merger Talks: A Legal Perspective

Japanese automotive leaders Honda Motor and Nissan Motor are reportedly entering negotiations for a potential merger, according to an exclusive report by Nikkei. The move aims to create a single holding company to boost competitiveness against industry frontrunners like Tesla and BYD in the electric vehicle (EV) market. Mitsubishi Motors, in which Nissan holds a significant stake, may also be brought into the entity, potentially forming one of the world's largest automotive conglomerates.

Strategic Implications and Legal Considerations

The merger talks come after Honda and Nissan deepened ties in March, agreeing to explore strategic collaborations in EVs and related sectors. However, transitioning from strategic partners to a unified entity under a holding company brings significant legal complexities.

Key legal considerations for the merger include:

-

Antitrust and Competition Law

Combining Japan's second and third largest automakers will likely invite scrutiny under Japan’s Antimonopoly Act and similar laws in key global markets like the United States, Europe, and China. Regulators will assess whether the merger could distort competition, particularly in the EV segment, where Tesla and Chinese manufacturers already hold a significant advantage. -

Corporate Governance Structure

Merging entities with independent management styles and shareholder bases will necessitate crafting a robust governance framework. The holding company's bylaws must address decision-making authority, board composition, and the allocation of resources to ensure alignment with each company's strategic goals. -

Intellectual Property (IP) and Technology Sharing

Both Honda and Nissan have heavily invested in EV technology. A merger would require IP integration agreements to govern technology sharing and protect proprietary innovations. Legal safeguards must also ensure that confidential data is not exposed to external competition during negotiations. -

Labor and Employment Laws

Integrating two major corporations could impact thousands of employees across Japan and global operations. Labor laws, union agreements, and employment contracts in various jurisdictions must be carefully evaluated to avoid disputes and ensure compliance. -

Shareholder and Stakeholder Approvals

Shareholders, especially minority stakeholders, will play a crucial role in approving the merger. Honda and Nissan must ensure transparency and adhere to Japan’s corporate disclosure requirements to mitigate potential resistance. Additionally, bringing Mitsubishi Motors into the holding company would require its shareholders' approval, further complicating the process.

Global Context and Competitive Challenges

The merger reflects Japan’s urgency to regain its footing in the EV market. While Honda announced plans in May to invest $65 billion in EVs by 2030, Nissan is preparing to launch 16 electrified models in the next three years. Despite these ambitions, Japanese automakers have lagged behind Chinese and Western manufacturers, who dominate EV exports and infrastructure development.

Analysts highlight that the focus on hybrid vehicles—a segment accounting for 40% of Japan’s domestic sales in 2022—has hindered Japanese firms' ability to capitalize on the growing global demand for pure EVs. By consolidating resources, Honda and Nissan aim to scale their operations and compete in the high-stakes global EV market.

Potential Regulatory Outcomes

Should the merger proceed, it will likely set a precedent for Japan’s automotive industry, which has traditionally resisted large-scale consolidations. A successful merger could pave the way for other automakers to adopt similar strategies. However, failure to secure regulatory approvals or adequately address stakeholder concerns could result in significant financial and reputational risks.

Conclusion

The Honda-Nissan merger represents a pivotal moment for Japan's automotive industry, offering both significant opportunities and challenges. While a single holding company could position the two automakers as global EV leaders, navigating the legal landscape will require careful planning and execution. The coming months will reveal whether the merger can withstand the scrutiny of regulators, shareholders, and global competition.

For any enquiries or information, contact info@thelawreporters.com or call us on +971 52 644 3004. Follow The Law Reporters on WhatsApp Channels