Samana Developers Appoints Complyfin to Enhance AML/CFT Compliance

The system will strengthen Samana Developers' AML/CFT regulatory compliance

In a strategic move to enhance transparency and security, Samana Developers, a prominent real estate company, has appointed Complyfin, an affiliated solution provider of Dow Jones, to manage their Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) compliance measures.

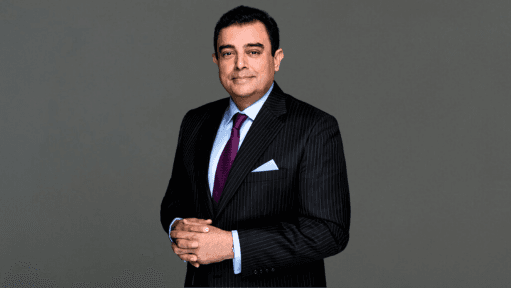

Imran Farooq, CEO of Samana Developers, stated: “As a leading real estate developer in Dubai, we recognise the importance of maintaining utmost transparency and integrity in all our operations. Implementing AML/CFT compliance measures demonstrates our commitment to ethical business practices, fostering a secure and trustworthy environment for our customers and stakeholders.

We have appointed Dow Jones-affiliated Complyfin to ensure comprehensive AML/CFT compliance across our operations.”

He added: “It is our shared responsibility to ensure our investors' security and safety in compliance with UAE regulations. Samana Developers has successfully tested and deployed this flexible solution to manage various regulatory obligations and workflows, enhancing our overall AML/CFT regulatory compliance regime.”

Complyfin is a solution from Dow Jones Risk & Compliance, a division of Dow Jones & Company, a leading provider of news, data, and analytics. Complyfin helps businesses manage regulatory compliance obligations, focusing on AML, CTF and Know Your Customer (KYC) requirements.

Dow Jones Risk & Compliance offers tools and services to navigate complex regulatory landscapes and mitigate financial crime risks, including screening for sanctioned entities, politically exposed persons (PEPs), adverse media, and due diligence checks.

The adoption of AML/CFT compliance measures reflects Samana Developers' proactive approach to mitigating financial risks and combating illicit activities, in line with UAE regulations and international best practices. Integrating these measures aims to enhance the company’s ability to detect and prevent financial crimes, fortifying its reputation as a responsible developer.

Samana Developers has established a policy to govern cash receipts for unit sales, ensuring compliance with AML laws. Customers are limited to cash payments of up to Dh55,000 ($15,000) per unit, with any amount exceeding this limit to be settled through non-cash methods such as bank transfers or credit/debit cards.

Compliance with this policy is a collective responsibility across all operational departments. It is crucial for property consultants and brokers to adhere strictly to this policy in their daily operations, ensuring robust compliance and operational integrity.

For any enquiries or information, contact ask@tlr.ae or call us on +971 52 644 3004. Follow The Law Reporters on WhatsApp Channels.