Indian Court Orders Investigation into Former SEBI Chief Over Stock Market Fraud

Mumbai Court Directs Probe Into Allegations Against Madhabi Puri Buch and SEBI Officials

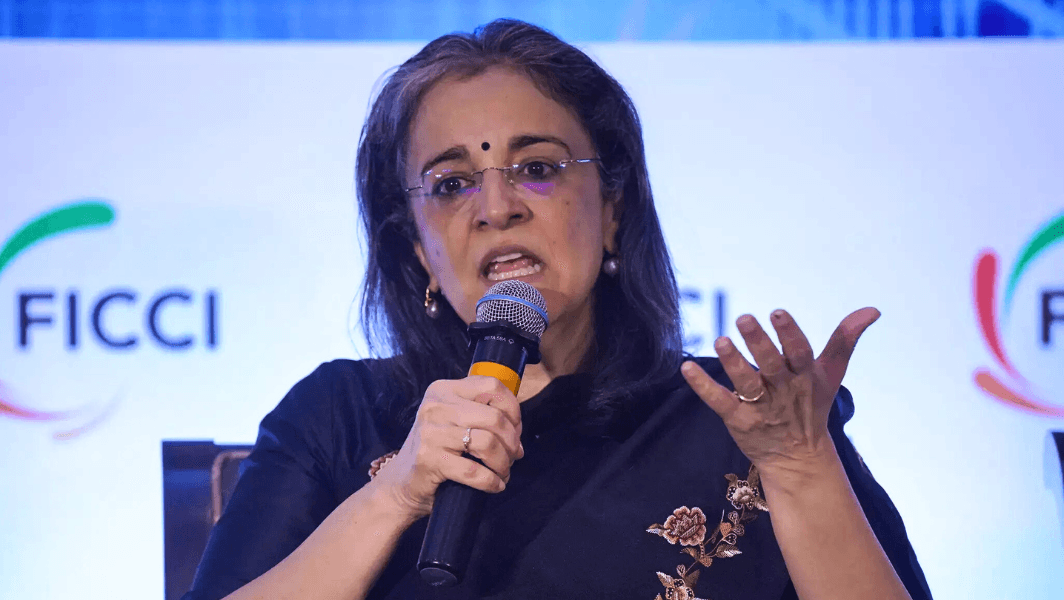

A court in India’s financial capital has ordered an investigation into former Securities and Exchange Board of India (SEBI) chief Madhabi Puri Buch and five other officials over alleged stock market fraud and regulatory violations.

The anti-corruption bureau has been tasked with conducting the probe after the court cited inaction by SEBI and other law enforcement agencies, making judicial intervention necessary, according to a report by Press Trust of India (PTI).

SEBI's Response: Legal Challenge in the Works

In a statement, SEBI clarified that the case stems from alleged irregularities in the listing of a company on the Bombay Stock Exchange (BSE). The regulatory body stated that it was not given an opportunity to present its side and that the accused officials were not in their respective positions at the time of the alleged violations.

SEBI further added that it plans to challenge the court’s decision and reaffirmed its commitment to regulatory compliance and transparency.

Buch's Past Controversies and the Adani Group Link

This is not the first time Madhabi Puri Buch, who completed her tenure as SEBI chairperson last week, has faced scrutiny.

In 2023, US-based short-seller Hindenburg Research accused Buch of potential conflicts of interest, alleging that her past offshore investments may have influenced her handling of corporate fraud allegations against the Adani Group.

The report suggested that Buch and her husband held investments in offshore funds allegedly linked to a senior Adani family member, raising concerns that SEBI might have been reluctant to investigate the conglomerate thoroughly.

Buch denied these allegations as "baseless", but the controversy fuelled opposition calls for her resignation.

Political Fallout and Market Impact

The opposition Congress Party, led by Rahul Gandhi, had earlier accused SEBI of being “gravely compromised”, demanding both Buch’s resignation and a joint parliamentary investigation into the regulator’s handling of the Adani case.

The Adani Group, one of India’s largest business conglomerates, lost billions in market value in 2023 after Hindenburg Research’s report accused it of "brazen corporate fraud."

With the latest legal action, SEBI’s regulatory independence is once again under the spotlight, as the market watches how the case unfolds.

For any enquiries or information, contact info@thelawreporters.com or call us on +971 52 644 3004. Follow The Law Reporters on WhatsApp Channels