SEC Chair Warns Staff Shortages Have Left Critical Gaps in Agency Oversight

Paul Atkins tells Congress that a wave of employee buyouts has undermined the SEC’s enforcement capacity; the expert warns of long-term risks to regulatory effectiveness.

Congressional Testimony Highlights Alarming Workforce Decline

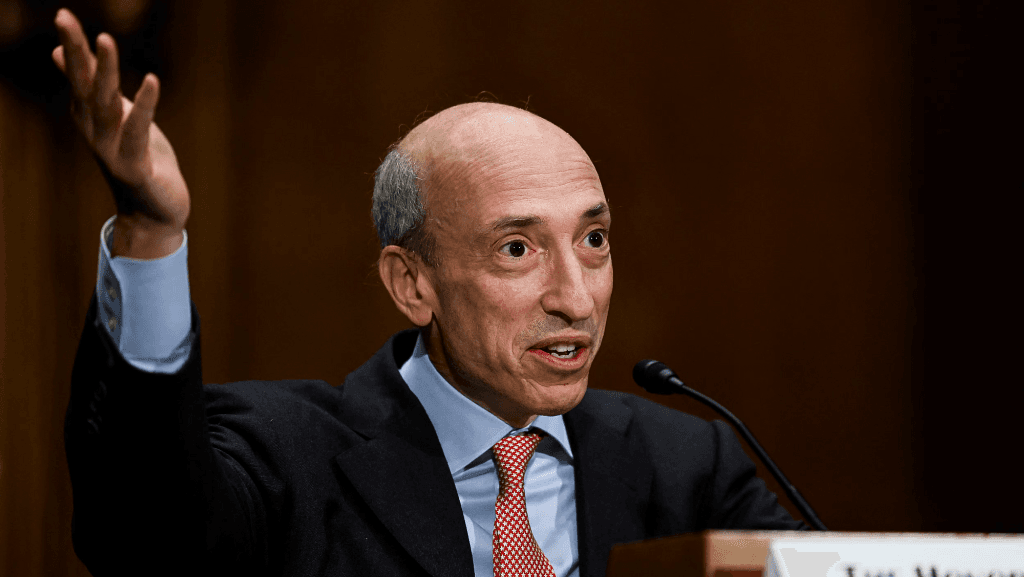

U.S. Securities and Exchange Commission (SEC) Chair Paul Atkins appeared before the House Financial Services Committee on Tuesday, raising urgent concerns over the agency's ability to maintain market oversight in the wake of widespread staff departures. Atkins described the SEC’s current staffing crisis as “unprecedented in scale,” revealing that hundreds of experienced employees have exited the agency following buyouts and early retirement incentives introduced in late 2024.

While exact numbers were withheld for security and confidentiality reasons, internal sources suggest that upwards of 15% of the SEC’s total workforce may have left in recent months. Among many from key departments such as Enforcement, Trading and Markets, and Investment Management.

“We’ve lost some very talented individuals with deep institutional knowledge,” Atkins told lawmakers. “Rebuilding that expertise won’t happen overnight, and the vacuum this creates is already being felt across our regulatory and enforcement operations.”

Mass Exodus Linked to Federal Cost-Cutting Measures

The exodus comes in the wake of a federal cost-reduction initiative aimed at shrinking government payrolls via voluntary separation incentive payments (VSIPs) and early retirement authority (VERA) packages. Though the programme was designed to encourage a leaner government structure, its impact on critical regulatory bodies like the SEC has raised eyebrows.

According to documents reviewed by The Law Reporters, the SEC approved more than 300 buyout applications between November 2024 and March 2025, most of them from senior-level staff and mid-career professionals in specialised legal and financial roles.

Analysts warn that these exits could create a ripple effect, hindering the agency’s capacity to respond to emerging threats and fast-moving developments in the financial markets.

Challenges in Enforcement and Rulemaking

The staffing shortage is already having tangible effects. Sources within the SEC have indicated that several major enforcement cases, including investigations into crypto asset fraud, insider trading, and non-compliant ESG disclosures, have experienced delays due to insufficient manpower.

Legal filings show that scheduled timelines for compliance rule updates in sectors such as fintech, derivatives, and digital asset custodianship have also been postponed.

“The complexity of modern financial markets requires experienced hands,” Atkins stated. “These are not roles you can fill and train for overnight.”

Expert Insight: Sunil Ambalavelil on Long-Term Implications

Sunil Ambalavelil, a leading international financial law expert and Chairman of Kaden Boriss, weighed in on the potential impact of the SEC’s shrinking workforce:

-

“Institutional knowledge isn’t easily replaced. It can take years for new hires to understand not just the law but the practical regulatory context in which it’s enforced.”

Ambalavelil also noted that the SEC’s predicament underscores a larger issue facing regulatory agencies globally: the need for sustainable workforce strategies in a rapidly evolving financial ecosystem.

Recruitment Underway—But Private Sector Competition Is Fierce

Atkins confirmed that recruitment efforts are ongoing, with the agency prioritising roles in cybersecurity, digital asset regulation, forensic accounting, and litigation. However, he acknowledged the intense competition the SEC faces from the private sector, where compensation packages for compliance and regulatory experts often far exceed what government agencies can offer.

“It’s difficult to compete with Wall Street or Silicon Valley when it comes to attracting top-tier talent in fintech and cybersecurity,” he noted.

Some critics have also pointed to the SEC’s lengthy hiring process, often taking several months to onboard even critical hires. Observers say modernising the agency’s HR and recruitment workflows may be just as urgent as filling vacancies.

Investor and Industry Reaction

Market participants have taken note of the SEC’s staffing challenges. While the agency has not missed any statutory filing or review deadlines to date, compliance professionals at various large financial institutions have reported longer wait times for approvals and delayed responses to regulatory enquiries.

Outlook for SEC Reform

With the financial sector becoming more digitised, decentralised, and data-driven, the need for a technically sophisticated and fully staffed securities regulator has never been greater.

Legal experts say the SEC’s current situation should serve as a warning to other financial regulatory agencies around the world.

As Congress deliberates future budget allocations and the SEC continues its internal reshuffling, stakeholders across the legal, financial, and investor communities will be watching closely for signs of stabilisation and renewed strength.

For any enquiries or information, contact info@thelawreporters.com or call us on +971 52 644 3004. Follow The Law Reporters on WhatsApp Channels.